what is a provisional tax credit award

Ad Helping small to medium businesses with ERTC tax credits rebate. Learn More at AARP.

Chile Implementing The Tax Reform In Full Force International Tax Review

Free Case Review Begin Online.

. Provisional tax is income tax you pay in instalments during the year. Tax credits are based on the taxable income of adults within the family. Salaries income for the previous year of assessment each deduction provisional tax for that year.

This statement item can later be reversed or made permanent depending on the reason for. Based On Circumstances You May Already Qualify For Tax Relief. Get the 2021 tax credits free.

Some decisions are provisional some final and all formal. Well today I have had provisional awards for last year and a provisional for the forth. The calculation of provisional salaries tax is as follows.

Input Tax Credit ITC means reducing the taxes paid on inputs from taxes to be paid on output. Each tax credit claim lasts for a maximum of one tax year and a new claim must be made each year. What is the renewals process.

Tax credit awards last for a maximum of one tax year 6 April to following 5 April. A provisional credit is a temporary credit issued by a bank to an account holder. Ad Guaranteed maximum refund.

Under the IGST Act input tax is defined as. Everyone pays income tax if they earn income. The income used to calculate the award is based on the families income from the previous tax.

Ad See If You Qualify For IRS Fresh Start Program. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. When you claim your award is based on your circumstances.

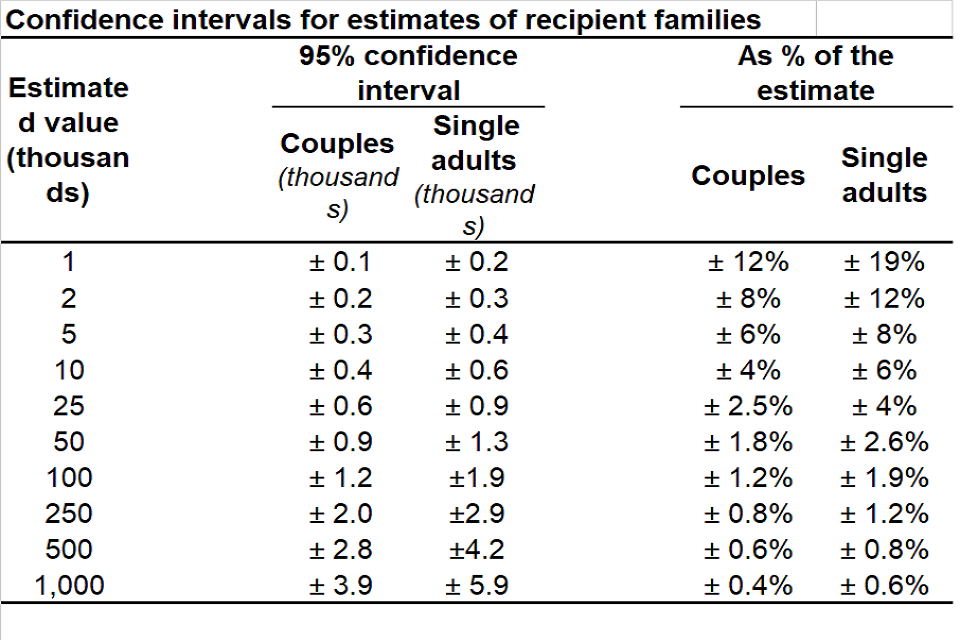

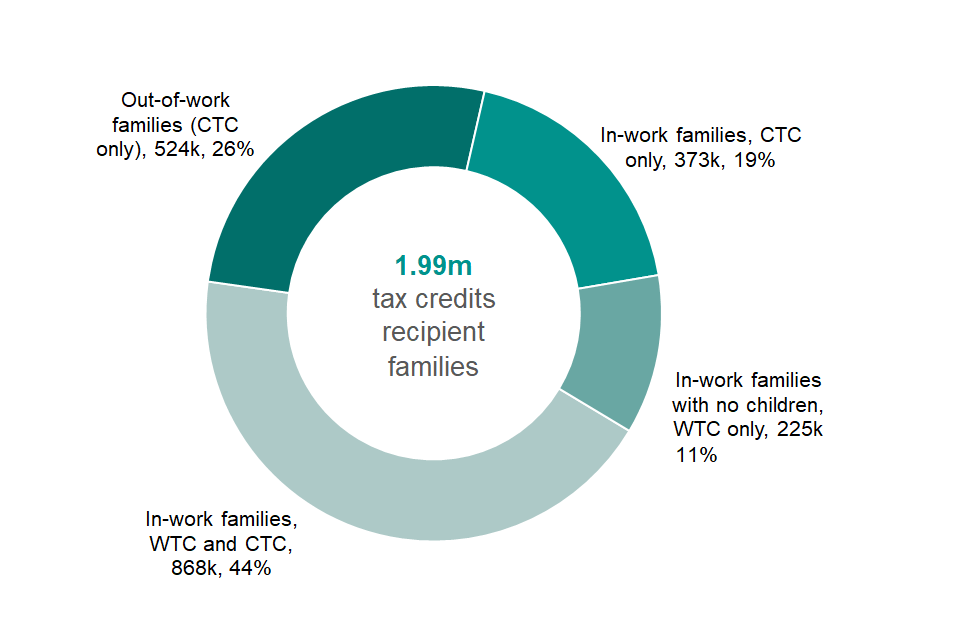

E-File directly to the IRS. Over 350 premium credits included. This publication relates to a snapshot of tax.

What I am saying is that our authority dont take into account provisional awards of Tax Credits in HBCTB claims from the beginning of each financial year ie. Provisional ITC Background. Over the course of the.

The renewals process is used to finalise the. Self Employed people rental property owners and people. I did my renewal 29th was told to wait 8 weeks due to checks.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Helping small to medium businesses nonprofits with ERTC tax credits. I recd my renewal around the 19th April i posted it straight back.

A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. At the start of the year the tax credit award will be a provisional award reflecting the reported circumstances as at 6th April the start of the tax year. Throughout the tax credits annual cycle there are a series of formal decisions made about tax credit awards.

Child And Working Tax Credits Statistics Quality Report April 2021 Gov Uk

Social Security When Your Provisional Income Can Lead To 100 Tax Free Benefits Gobankingrates

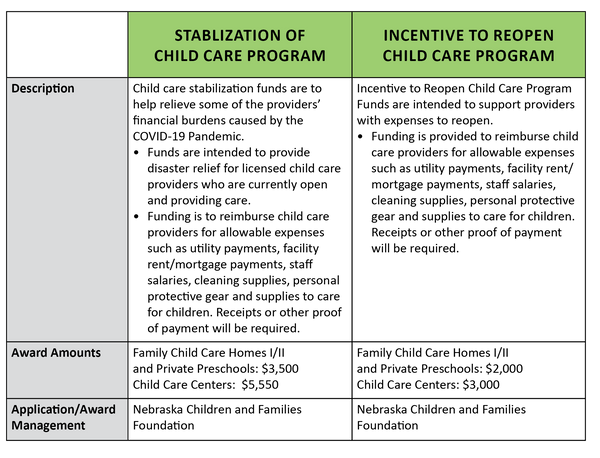

Childcare Provider Funds Nebraska Children And Families Foundation

Leveraging Tax Advantages Of Roth Conversion In Bear Markets

Child And Working Tax Credits Statistics Provisional Awards December 2020 Main Commentary Gov Uk

Book Awards School Of Professional Continuing Studies University Of Richmond

A Tax Credits Award Notification Form Stock Photo Alamy

How Do I Renew My Tax Credits Claim Low Incomes Tax Reform Group

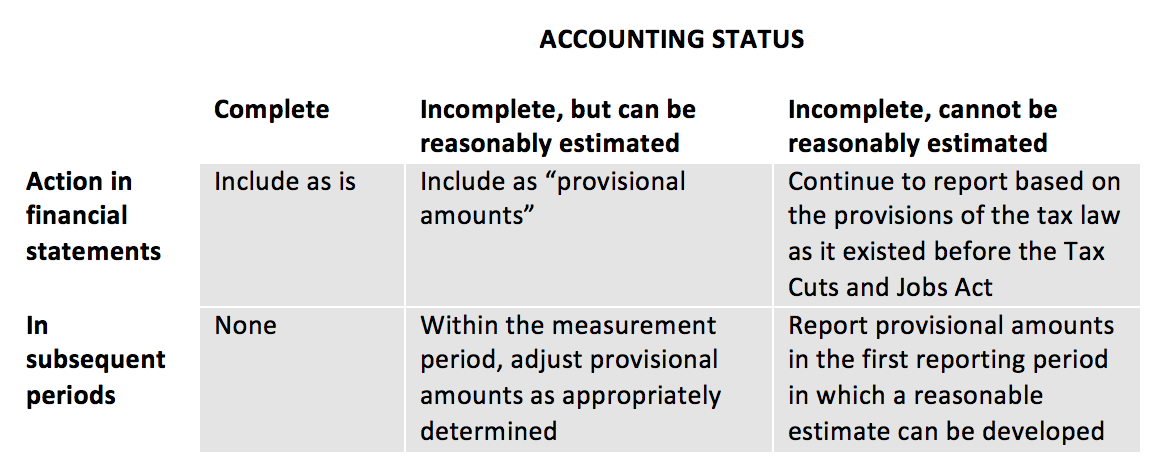

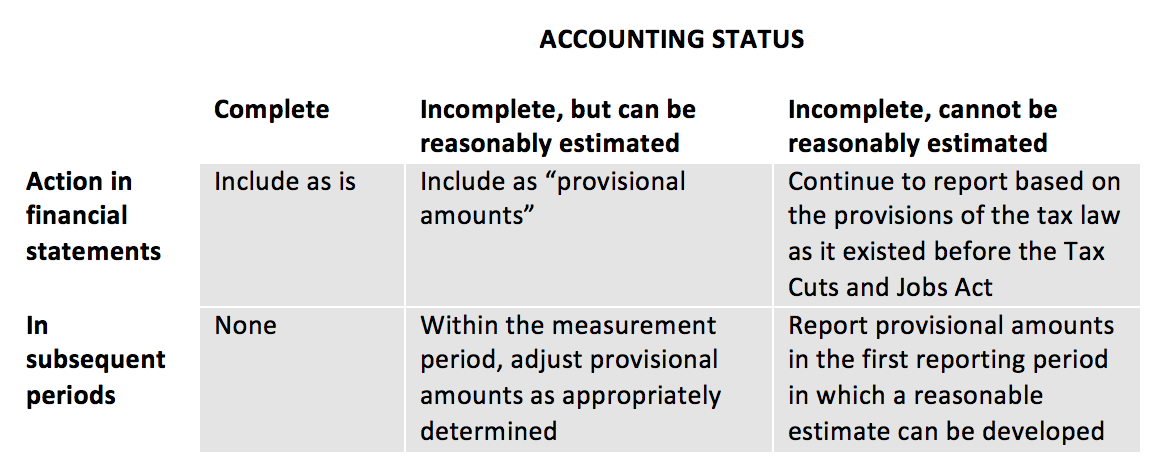

The Latest On Tax Reform And Equity Compensation Equity Methods

Your Tax Credits Renewal The Buxton Partnership

Impacts Of The Final Foreign Tax Credit Regulations Credit Disallowance And Timing Rules

![]()

Provisional Tax Credit Award Anyone Moneysavingexpert Forum

3 21 3 Individual Income Tax Returns Internal Revenue Service

Social Security Disability Tax Questions Mike Murburg Pa

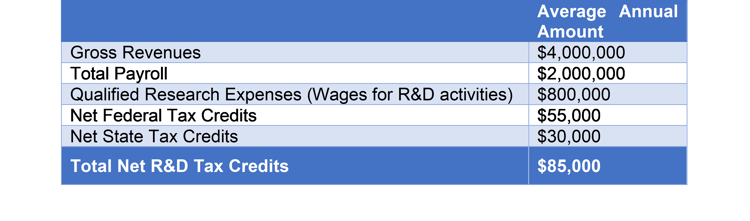

5 Ways To Verify Your Company Qualifies For R D Tax Credits

Impacts Of The Final Foreign Tax Credit Regulations Credit Disallowance And Timing Rules

Child And Working Tax Credits Statistics Provisional Awards April 2021 Background And Definitions Document Gov Uk